Build Your First Crore

My First ₹1 Crore

They say the first crore is the hardest to make, but it is also the most important step in your financial journey. You don’t need to win the lottery or pick a lucky stock; you just need discipline, time, and the right plan. By using the power of compounding and a balanced asset allocation, that 8-figure target changes from a distant dream into a mathematical certainty. Whether you are starting with ₹10,000 or ₹20,000, the roadmap is the same: start early, automate your investments, and let the magic of compounding take over.

Strategies to Reach ₹1 Crore

Proven investment approaches to achieve your financial goal

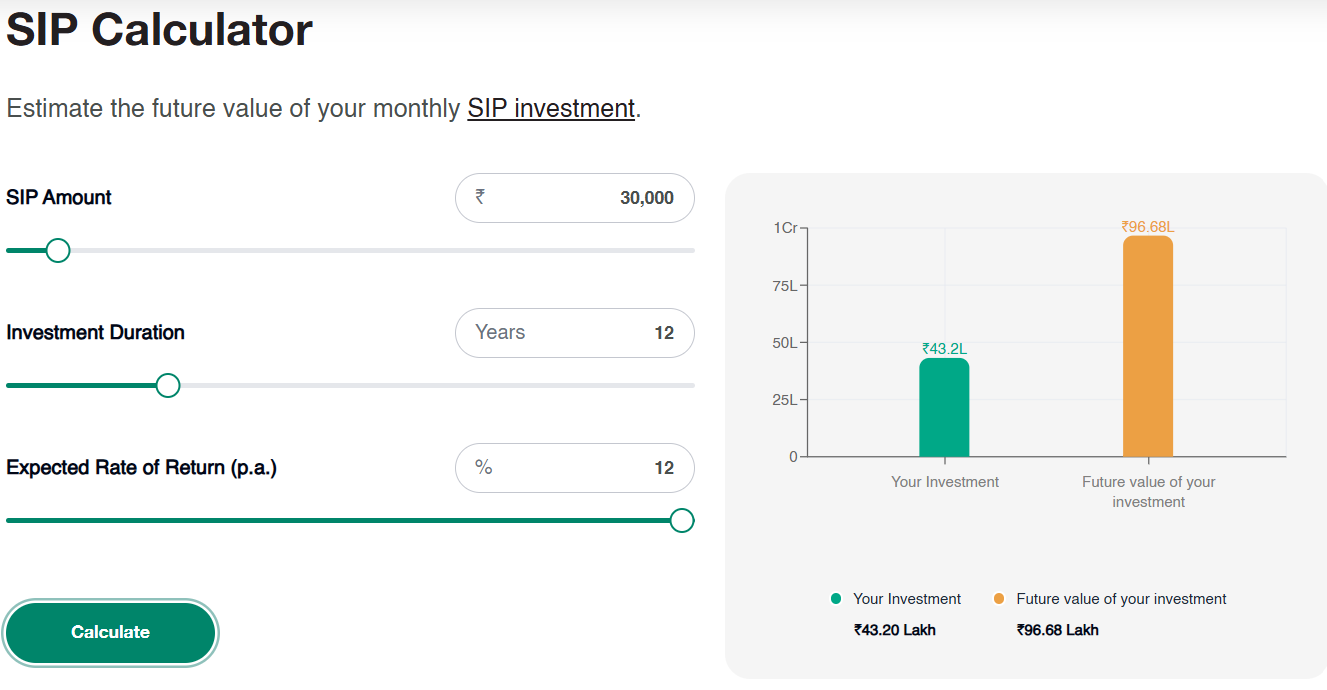

Start Early & Stay Consistent

Begin investing as early as possible. Even small amounts invested regularly can grow significantly over time due to compounding.

Increase SIP with Income

Boost your SIP amount by 10-15% annually. This accelerates your wealth creation and helps beat inflation.

Diversified Portfolio

Invest across different asset classes - equity, debt, and Metals (Gold/Silver) funds. This balances risk and optimizes returns.

Why are our plans the best for you?

Get the right funds for you

Unbiased fund selection, personalised recommendations, and asset allocation for your portfolio

Invest as a family

Create portfolios with multiple family member accounts, to help you plan finances and goals together.

Personalise growth strategy

Set a target and tag existing investments to your plan to personalise your recommendations.

Building substantial wealth is a function of patience and prudence, not speculation. By adhering to a structured asset allocation and maintaining SIP discipline, you transform the complex challenge of wealth creation into a predictable, manageable process.

Ready to start your investment journey?

Our team is ready to guide you through every step of the process.

Completely