The 7-5-3-1 Rule of SIP Investing in Mutual Funds

When you start investing in mutual funds, two key questions often arise: How long should I stay invested? and How do I plan my SIPs? The 7-5-3-1 rule provides a simple and effective framework to address both by breaking it down into four easy-to-follow principles.

What is the 7-5-3-1 Rule?

This rule relies on four basic elements. When you use them together, they strengthen your investment approach and improve long-term outcomes.

7 — Stay Invested for 7 Years

Equity markets can be unpredictable in the short run. Staying invested via SIPs for at least 7 years improves the chances of earning positive returns and allows compounding to take effect.

5 — Diversify into 5 Strategies

Spread your SIPs across diverse strategies, such as Large-cap, Mid/Small-cap, Flexi-cap, Value/Contra, Global, or GARP/thematic funds. This helps reduce risk from overexposure to one single theme.

3 — Expect 3 Emotional Phases

Investing involves emotions: Disappointment (modest returns), Frustration (low/flat returns), and Panic (market falls). Understanding these phases can help you avoid rash decisions. Also, ensure exposure to at least 3 asset classes—equity, debt, and gold for broader diversification.

1 — Increase Your SIP Once Every Year

Increase your SIP by a small percentage each year (e.g., 10%). As income grows, this step-up amplifies future corpus through compounding and inflation-beating potential.

Why follow this rule?

- It builds long-term discipline and patience.

- It encourages sensible diversification across strategies.

- It Prepares you mentally for market cycles.

- It leverages step-ups to beat inflation and accelerate corpus growth.

Things to watch out for

The 7-5-3-1 rule is a guideline, not a guarantee. Choose quality funds, keep an eye on costs (expense ratios and loads), and step-up only within your budget. Also, remember that some sectors or themes can underperform for longer than seven years.

The Power of Step-up SIPs

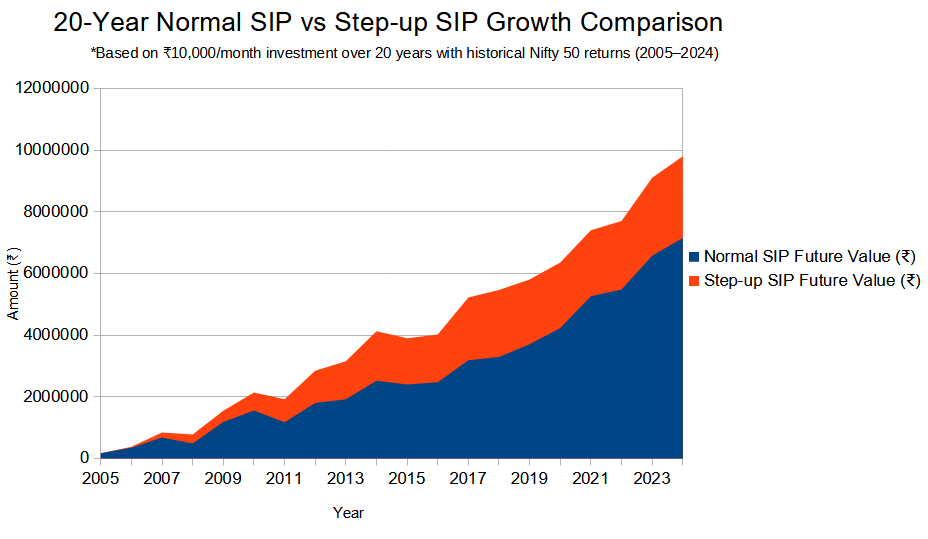

Here’s a visual comparison: a flat ₹10,000/month SIP vs a 10% yearly step-up SIP over 20 years. The step-up corpus grows significantly larger because compounding acts on increasing contributions.

Chart explanation

If you invest a flat ₹10,000 per month for 20 years, your corpus grows steadily. But if you increase your SIP by 10% each year, the final corpus is almost double. That happens because you invest larger amounts as your income grows, and compounding multiplies those higher investments over time. The step-up approach also helps your investments keep pace with inflation.

Key Observations from the Chart

- Consistent Growth: Both types of SIP show growth from compounding, highlighting the benefits of long-term equity investment.

- Step-up Advantage: The Step-up SIP consistently outperforms the Normal SIP due to increasing yearly contributions, highlighting the effect of gradual investment increments.

- Impact of Market Fluctuations: Since the calculation uses actual Nifty 50 returns, years with high returns (e.g., 2009, 2014) result in visible growth spikes, while negative-return years (e.g., 2008, 2011) show temporary dips in overall growth.

- Future Value Difference: At the end of 20 years, the Step-up SIP yields a significantly higher corpus, emphasizing the advantage of increasing investments over time alongside market growth.

A Practical Example (simple)

Start with ₹10,000 per month. Apply a 10% step-up each year. After 20 years — assuming the same returns — the step-up route builds a noticeably larger corpus than the flat SIP. Use a SIP calculator or spreadsheet to test different rates and timeframes for your situation.

Final thoughts

The 7-5-3-1 rule is not magic, but it’s a practical, repeatable framework for SIP investors. Combine time (7+ years), diversification (5 strategies), emotional readiness (3 phases), and consistent contribution growth (1 step-up) to create a robust investment habit.